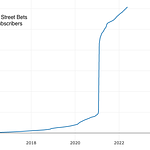

Since mid-2020 to Jan. 2022… we’ve been in strong market conditions for risk assets due to massive stimulus and tailwinds from lockdowns.

We were in a period where our trades were clear, and working.

You could jump from Layer-1 to Layer-1.

You could mint and flip JPEGs you knew nothing about.

You could sector rotate to gaming, metaverse.

You could stay MAX-Long and be rewarded for it.

Now this has broken down as tightening concerns are on the horizon and market participants are rethinking strategies and valuation multiples.

I don’t know what will happen next, but my sense is that this is the most dangerous time (short term) for retail investors.

In this audio I share a bit of my thinking.

This is not to FUD but just to help you play the longer-game, one that helps you not put yourself in an over-extended position.

It’s a time to conserve your energy, have patience, and most of all, not blow up.

In the long run my personal thesis has not changed much.

That doesn’t mean there are short term risks worth managing for yourself if you are overextneded.

If this is a race, it’s time to bring it back to a jog that can sustain, rather than a sprint.

What this might mean for you:

Raising cash from names you don’t have conviction in

Raising cash to ensure your cash-flow is ok for a 3, 6+ months

Mentally prepping for volatility.

Being open minded, and flexible to observe without bias

Things can change fast, yet, you don’t want to topple over the precipice by running so fast you didn’t know it was right ahead of you.

XX I’m David Sherry, I coach early-stage founders, invest in crypto, and write on the overlap of investing, crypto, and the creator economy.

You can join my Telegram chat for more real-time notes on what I’m thinking.

Share this post