More than ever, we have new options for investing. What used to just bonds became stocks and bonds, and then become stocks, bonds, derivatives, Forex etc. and now to crypto.

It’s to the investor’s benefit that many different investment opportunities continue to emerge.

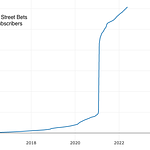

My excitement with crypto, in part, sparked with the realization that the number of investible assets would trend toward infinity.

Given that we have more assets to invest in, I don’t think people have quite really dissected or discussed the balanced relationship of these new assets to traditional assets.

What I mean is that, undoubtedly, portfolio construction will look different in a world with dozens of new asset classes.

While all financial innovations are just repackaging of simple primitives, this still doesn’t mean that how we invest in the future will look the same as today.

What’s most interesting to me at the moment is the interplay of 4 different “investing buckets” that you can rotate between depending on your porfolios construction.

Ironically, each of these buckets owns its own space on Twitter. While many people are focused deeply on their own verticals, not that many are discussing the mixture of them altogether.

So, this concept is naturally not for maximalists.

Here is the breakdown of the different buckets:

1: IRL Speculative Investing

This bucket is Venture Capital and Angel Investing.

This is where you speculate on “Web2” or traditionally structured VC and angel deals. You gain value by an end-state liquidity event that is a price massively higher than your original investment. It is a speculation on future value.

Risk: Total Capital Loss

Benefit: Robust market processes, high multiple returns.

2: Digital Speculative Investing

This bucket is token and NFT investing.

This is where you speculate on the future value of Web3 assets. You gain value when the price massively appreciates, and you can take liquidity at any stage along teh way.

Risk: Market Cycles, Total Loss, Rug Pulls, Regulation

Benefit: Massive Multiple on Price Appreciation, Immediate Liquidity

3: IRL Cashflowing Investing

This bucket is real estate and SMB investing.

This is where you buy a cash-flowing business, it’s the Laundromats, the Storage Lockers, the Apartment complexes. This is the type of person who wants an asset that pays them monthly, with little premium placed just upon the exit.

Risk: Market Cycles

Benefit: Cash Flow, Traditionally Safe Asset.

4: Digital Cashflowing Investing

This is yield farming and staking.

This is where you stake your tokens to produce regular cash/token flows. This is where you help risk bootstrapping new networks for immediate payment for staking services.

Risk: Rug pulls, Token price declines, Market cycles

Benefit: Incredibly high yield

So, how do you invest across each of these asset classes?

This is the question I’m getting at. How do you roll cash flow from Real Estate into Crypto, into startups, into yield farms, back into crypto, back into real estate…? And how do you do this in a tax-advantaged way? And how do you maximize returns?

I don’t yet have answers, and maybe this is too many skills to master. But I have a feeling those who find their own unique mix of these assets will outperform “traditional” portfolios while producing a new and unique format for generating returns over time.

XX I’m David Sherry, I coach early-stage founders, invest in crypto, and write on the overlap of investing, crypto, and the creator economy.

You can join my Telegram chat for more real-time notes on what I’m thinking.

Share this post