Hey and welcome to The Elevator. I share links to level up your life and business. Curated by

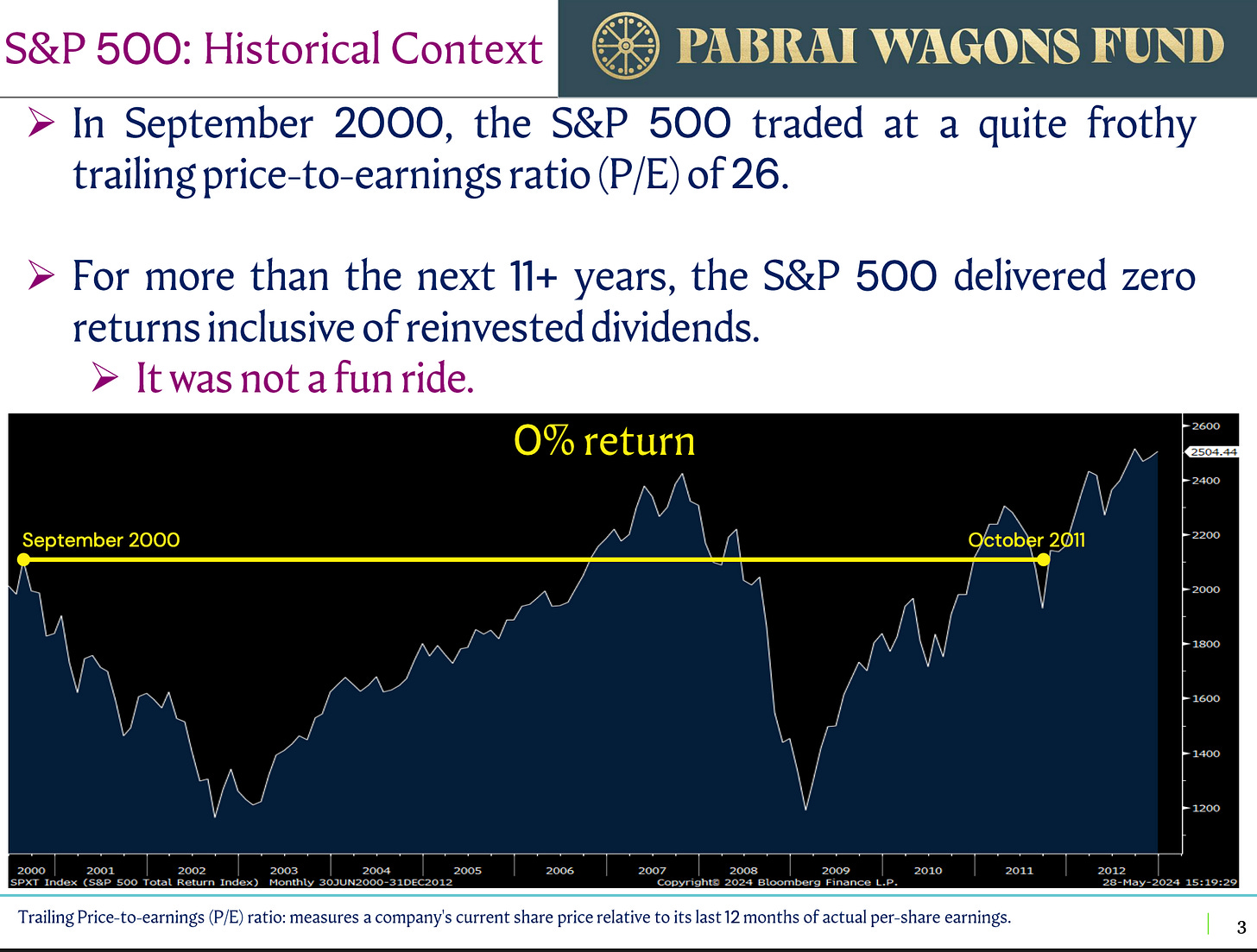

If you’re heavily invested in Tech, either as a career or through your portfolio, you’re likely pretty exposed to volatility. Now, volatility isn’t risk. But to weather the volatility I am building out a value-oriented side of my portfolio.

This makes the general barbell strategy of my portfolio:

[Concentrated Value] ––––– [Indexes/Gold] –––– [High-Tech/Crypto]

My edge as an investor is in two factors: Trend following and people. If I find the right trend, and back the right person within that trend, things usually work out. I basically ignore price. If it’s a strong trend with major upside so I’m less worried about buying at overvalued levels.

If it’s the right person, I’m less worried about specific choices they make, and more interested in their aggregate future performance. I think concentrated international value is non-consensus in that many people are using indexes as the bulk of their equities portfolio. The trend I’m betting on is this to become more consensus over time, with international equities to become more consensus over time.

This has led me to search for concentrated value funds that I can back.

Here are the funds that I’ve been researching…not financial advice of course.

1. Pabrai Wagons Fund (WAGNX/WGNIX)

Mohnish Pabrai’s “circles the wagons” around ~10 deep-value bets he’s willing to hold for a decade. Current top names—Edelweiss Financial, TAV Airports, Warrior Met Coal—tell you he’s fishing where others fear to swim: emerging-market financials, hard-asset energy, and infrastructure plays. Expect a portfolio heavily tilted to financials, energy/materials, and industrials, with almost no index overlap.

2. Akre Focus Fund (AKREX/AKRIX)

Chuck Akre’s famous “three-legged stool” (high ROIC + wide moat + savvy reinvestment) sits on just 15 holdings. Constellation Software, Mastercard, Visa, Moody’s, and Brookfield soak up half the fund, so you’re really buying a basket of cash-gushing tollbooths. Sector mix: ~50 % financials (payments + asset managers), 25 % tech, 10 % consumer, with the rest in real-estate-adjacent names.

3. Rainwater Equity ETF (RW)

Ex-TCW star Joseph Shaposhnik has bottled his “compounders only” mandate into an ETF that owns 15-25 recurring-revenue businesses—think software subscriptions, waste haulers, and stock exchanges. The bias is clear: software & services plus other contractual-revenue niches, held for the long haul. Just launched – June 2025 and seeded by Bill Miller.

4. Robert Hagstrom – Global Leaders Portfolio (EquityCompass)

The Warren Buffett Way author runs a 25-stock SMA of what he calls “world-class growth franchises.” Apple, Amazon, LVMH, Mastercard, and Berkshire headline the list, leaving the portfolio over-weight tech (~40 %), consumer discretionary/staples (~40 %), with the remainder in financials and comm-services. If you want mega-caps selling into a rising global middle class, this is it.

5. Constellation Software & Its Spin-Outs

CSU keeps the capital-allocation flywheel inside the mothership, while carving out region- or domain-specific “mini-Constellations” (Topicus, Lumine) to unlock equity incentives and focused M&A bandwidth—effectively multiplying its compounding engines.

Constellation Software (CSU.TO) – Mark Leonard’s buy-and-build powerhouse acquires >700 vertical-market software (VMS) firms, compounding free cash flow by decentralised autonomy and “never sell.” It is sector-agnostic inside VMS, owning everything from municipal ERP to auto-dealer DMS.

Topicus.com (TOI.V) – 2021 spin-out focused on European VMS platforms. It mirrors CSU’s playbook—85+ tuck-ins so far—serving Dutch gov-tech, fintech, and healthcare niches.

Lumine Group (LMN.V) – 2023 spin aimed at communications & media software (OSS/BSS, video platforms). Strategy: buy #1/#2 share vendors in narrow comms sub-verticals, then cross-pollinate.

Concentration Risk?

I assessed the concentration risk of the portfolio by going to GPT to try and figure out fund manager allocation overlap. I was also concerned I might dilute my strategy by picking

Here’s the prompt I used in GPT (assisted in the math) to understand those risks.

The TLDR is according to GPT it’s best to buy 3-5 of these funds, rather than 1-2 or 6+ for overall performance.

A note on Private vs. Public Markets

I see no difference in how I’m thinking about public vs. private markets. If it’s equity in a tech startup, it fits in my growth bucket. If it’s a cashflowing business, it fits in my value bucket.

I see active, micro-PE as a huge opportunity for the value side of the porfolio.

I prefer public markets because of liquidity and ease of entry.

I prefer private markets for cashflow and ability to add value to the portfolio.

We’re going to see a good deal more private access via tokenized stocks, so I’m just planning to wait for those entries. See, Robinhood’s latest announcment.

Quick Links

A newsletter built to elevate entrepreneurs,

From David Sherry, Founder of Death to Stock and Helping Founder’s Unlock Their Business .

Share with a friend who would enjoy!

David, Thanks for sharing. I respect the time invested and the sophistication you have cultivated. A couple questions. Re: AKRE, how do you see MC and VISA responding to crypto? What makes you feel value investing is a winner over the next decade? Why not just go with the best value investor in history BRK/B? Thanks in advance!