From Scarcity to Abundance: Decentralized Finance and Bittensor

What I find most interesting about blockchains like Bittensor is how it shifts our mindset from competition to collaboration.

The Elevator: Curated inputs to elevate your business and expand your lifestyle.

Hey All,

Another Money x Ai x investing post, so if that’s not your thing catch you again Friday.

Also feel free to message with any questions or feedback.

Let’s get into it…

Does AI need it’s own money?

I've been doing a deep dive into Bittensor (TAO), a new decentralized AI network built on the blockchain. It's a type of open-source software that builds on the ideas of Bitcoin and Ethereum. It’s been difficult to understand at first glance, so I wanted to share a bit more about it below. DCG’s Barry Silbert is shifting his focus to TAO, which is an interesting signal that made me pay more attention.

What's hard to wrap your mind around with these types of technology projects is that we're entering a world where products themselves can have their own currency unit. It’s sort of like a stock, but the stock has utility in the network.

When a technology has its own embedded currency unit, it functions sort of like an equity unit except it’s used in the network itself for utility.

Because every currency competes on a global stage, the introduction of technological, non-fiat currencies compete just the same for storing and transferring wealth. With Bitcoin, the first thing we did was start pricing it in dollars to understand its value. Since inception Bitcoin has drastically outperformed the dollar in terms of purchasing power, clearly winning the competition for value storage over the last 15 years (and remains to be seen for the next 100). Although not every cryptocurrency is competing on pure monetary values, there is some monetary aspect to tokens given that they have a hardcoded monetary policy.

Money is a human invention, and we are simply inventing more monies. We project our ideas of value onto things (rocks, shells, gold, paper). The monies we’re inventing today are not paper, but onto lines of code. Lines of code are smart, and are more “alive” than commodities that have unchanging physics-bound properties. To create this aliveness, you create coordination.

Smart contracts provide the trustless “guarantee” of future monetary policy and codebase. Social contracts unify a cultures shared sense of value. Staking, proof of work, and other proofing mechanisms provide the security.

Technological Disruption to Finance

After the launch of Bitcoin, we started thinking about how the world could look different in the future than it does today. Instead of an inflationary currency like the dollar, Bitcoin introduced a deflationary model (Bitcoin’s inflation rate declines over time). Instead of infinite supply, we have a fixed supply.

“Technology is a deflationary force no one can stop.’”

Jeff Booth explains that technology continually makes things cheaper, faster, and better, which means society benefits from abundance created by technological innovation. Technology drives down costs and increases value over time if left able to do so. Societies benefit from this deflation, except in cases where regulation, inflation, or other forces outweigh the technological forces driving costs down.

Think for example how Flatscreen TV’s have gotten cheaper, and you no longer need to buy a flashlight, or calculator, or even pay for mapping software. True college and healthcare costs have drastically risen… but all of this depends on which currency you are pricing in. If you live in Egypt and have faced incredible inflation to your currency making goods and services more expensive, that inflation only existed within the embedded currency you held.

The point is that we have a parralell, digital economy being born that exists outside of, and is intertwined with, our fiat economy’s and that consumers for the first time have a choice of holding a currency outside the physical system and into the purely digital. Even though college, housing, and healthcare increase in costs, those costs are priced in USD. When priced in BTC those costs are declining rapidly. Again, this is factually true for the last 15 years, and to me seems likely for the next 15.

In this world, we seamlessly and cheaply swap assets depending on our moment to moment preferences. In a digital world you’re freed from physical frictions.

Competition AND Collaboration

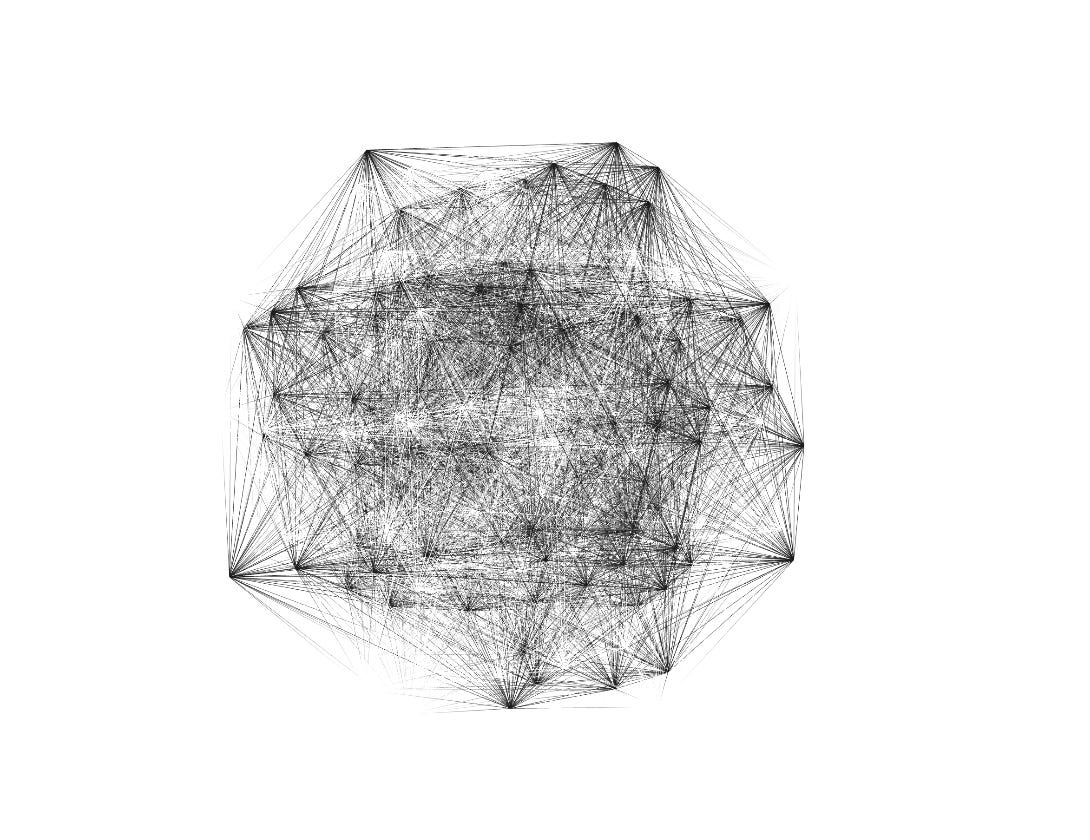

Bittensor can be seen as an open-source AI city with its own currency, TAO. Just like Ethereum allows developers to create value on top of its platform, Bittensor encourages innovation in the open source AI space. The more people build on TAO, the more valuable the network becomes. It’s like every city having its own currency, and as the city thrives, so does its currency.

Bittensor has created an incentive mechanism for people to build open-source AI models to build into a super-stack of AI services all powered by TAO. The bet is that you can build an OpenAI competitor that’s open source, global, and perfmissionless and you can do it by creating and coordinating the right incentive structure rather than a company. OSS capital is a large investor in Bittensor, and has a history of writing checks into open source projects. I do not participate or know much about open source, I simply take these types of investors taking the project seriously as something to note.

What I find most interesting about blockchains like Bittensor is how it shifts our mindset from competition to collaboration. When everyone is building on the same network, you're not just competing for a share of the currency; you're actually making the network stronger for everyone. This takes the open-source model and puts a value capture mechanism right at the heart of it.

Shared state, shared city

It’s like having a neighborhood where every new business adds value to the entire community, making everyone’s real estate more valuable. Except, in this case the currency tied to the network can rise in value. This means that rather than pure competition, there’s a collaborative element: everyone benefits from the growth of the network.

Thousands of people market these networks voluntarily. In a sense, you work for a protocol, and you get paid in it’s token. And if you and others do a good job in building the economy, you benefit from an increase in services, while also benefitting from currency appreciation.

How does this connect to the above? If you can bootstrap a network with a purpose and incentive model, people will perform work for the local currency unit (TAO). People move their work to this “city” and try and create value for others in and outside of the network. Because the token is nascent, they are speculating that this city will, in general, improve.

Even if you FAIL at creating a large amount of value, if you acquire TAO in the process of creating *some* value for the network (by earning TAO), your earnings could be larger if the network takes off, than if you created a large amount of value for a network in a currency that’s depreciating. Yes, you have to use Dollar currency to pay your bills, but your dollar currency is locked into a monetary system that is manipulated politically. Bittensor and other networks have their own manipulations, but the monetary policy is baked into the code.

Scarcity → Abundance

In this new world, it makes sense that we’re also seeing a transformation in how we think about value and growth. Instead of infinite money supply, we have scarcity driving value, and everyone benefits from each other’s contributions (abundance). If you can bootstrap networks like TAO, you introduce economies that have market forces of collaboration and competition. This is true for capitalism, but it drives it to an even higher-gear thanks to the native token for the economy being bootstrapped alongside the technology network itself. If you earn and hold TAO, you want more people create value on top of Bittensor. They are your competition (for the finite asset) and also your collaborator (driving value to the whole project).

I’m still fully trying to Grok the concept of Bittensor, and like any high risk project in the space it’s likely to fail.

Regardless, there are people who are putting their time, money, and attention into and around these networks without any centralized party governing the process. This is voluntary effort to bootstrap value in new domains.

The last decade taught us that code can become money. Let’s see what the next decade teaches us…

xx David

Have a great week,